Why buy gold?

Gold has captivated the world for years due to its intrinsic beauty and rarity. Beyond its allure, the history of gold prices reflects its role as a cornerstone of economic systems, a trusted store of value, and a safeguard against financial uncertainty

Why you should consider silver investment

Why invest in silver?

Silver has been used for jewellery and precious objects for as long as it has been a store of value. However, as the supply of silver increased relative to gold so its value compared to gold diminished. It is believed that by about 1600BC the availability of silver was such that it had fallen to half the price of gold. Today an ounce of silver costs a little above 1% the price of gold.

Silver's availability, plus its unique properties as a precious metal, now underpins its many industrial, medical and technological uses. This sets silver apart from gold as an asset to invest in, by making it an indispensable metal for the modern age.

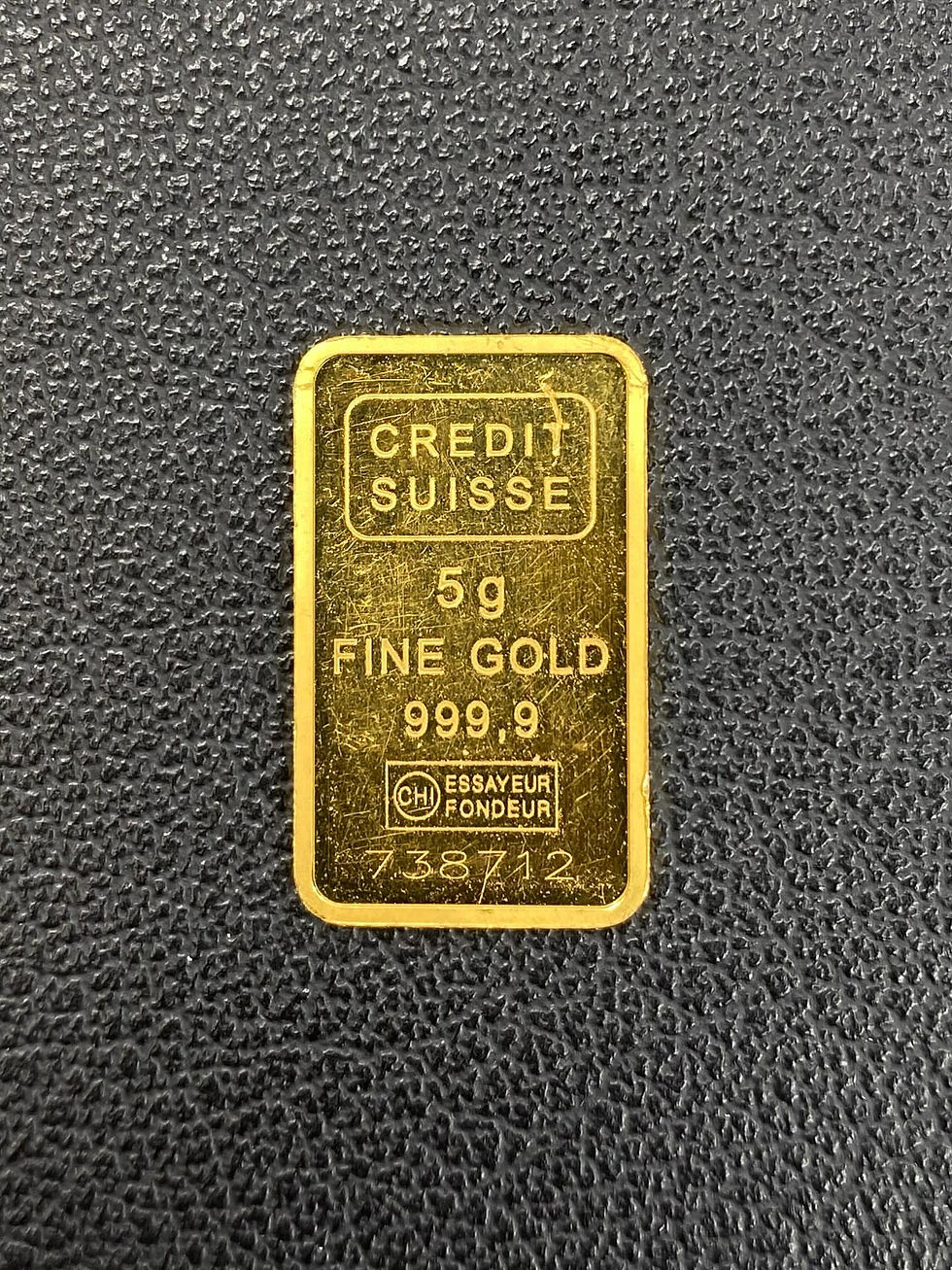

Should I Invest in Gold Bars or Gold Coins?

One of the most common questions we get asked is "should I buy gold bars or gold coins"? Whether you’re new to bullion investment or not, deciding which to invest in - bullion bars or bullion coins - should be given some consideration. Before making this decision, it would be advisable that you conduct your research as there is no definitive right or wrong answer, it will vary depending on the needs and circumstances of the individual investor. Trends can also change over time depending on market conditions. There are a several factors to consider including the value of your investment and the product premiums, how long you plan on keeping it, where to store it, and how you plan on realising the value of your investment.

Special Offers

Should investors consider platinum?

The first decade of this millennium saw the price of platinum outperform gold.

The differential became less marked during the GFC and since 2015 the pendulum has swung firmly back in favour of gold. Today, the price of platinum is significantly lower than the price of gold.

And yet, platinum was the best performing precious metal of 2022, up around 11% to about AUD 2,135 an ounce over the year, compared to a rise of just 0.18% for gold.

Could this be a sign of things to come? There’s certainly a lot riding on platinum at present thanks to its increasingly important role in decarbonisation. As a result, savvy investors might want to find out more.